Advanced Estate Planning & Elder Law Attorneys In Lexington & Northern Kentucky

At Elder Law Lawyers, our firm’s main goal is to save you as much money as possible while safeguarding your benefits. We believe in empowering our clients with options and knowledge, ensuring you feel confident in your decisions.

When you choose our team, you’re choosing advocates who are committed to your financial well-being and the welfare of your family. Trust us to navigate the complexities of elder law and experience the peace that comes with knowing you’re in capable hands.

3 Steps to the Peace of Mind You Deserve

You’ll meet with our seasoned attorneys to discuss options that will work for your family’s unique financial situation.

We’ll use our deep knowledge of elder law to create a plan that focuses on a high quality of life while also securing your assets.

When there’s a plan in place, you can rest assured knowing your estate is handled and your family is covered.

Our Experienced Elder Law Attorneys Offer These Services and More

Don’t wait until you’re under pressure to make senior care or estate planning decisions. Speak to a member of the Elder Law Lawyers team today and schedule your consultation. We’re committed to providing actionable insights and personalized legal support to suit your budget and your long-term needs.

Feel confident with a secure plan for the future.

Pre-Planning & Crisis Plans

Handling these decisions while also dealing with a crisis is stressful. While pre-planning allows you to save significantly, we are also able to help in a crisis.

Social Security & Medicaid

Structuring assets to qualify for Medicaid will help protect your family’s estate from spending unnecessarily on long-term care.

Long Term Care

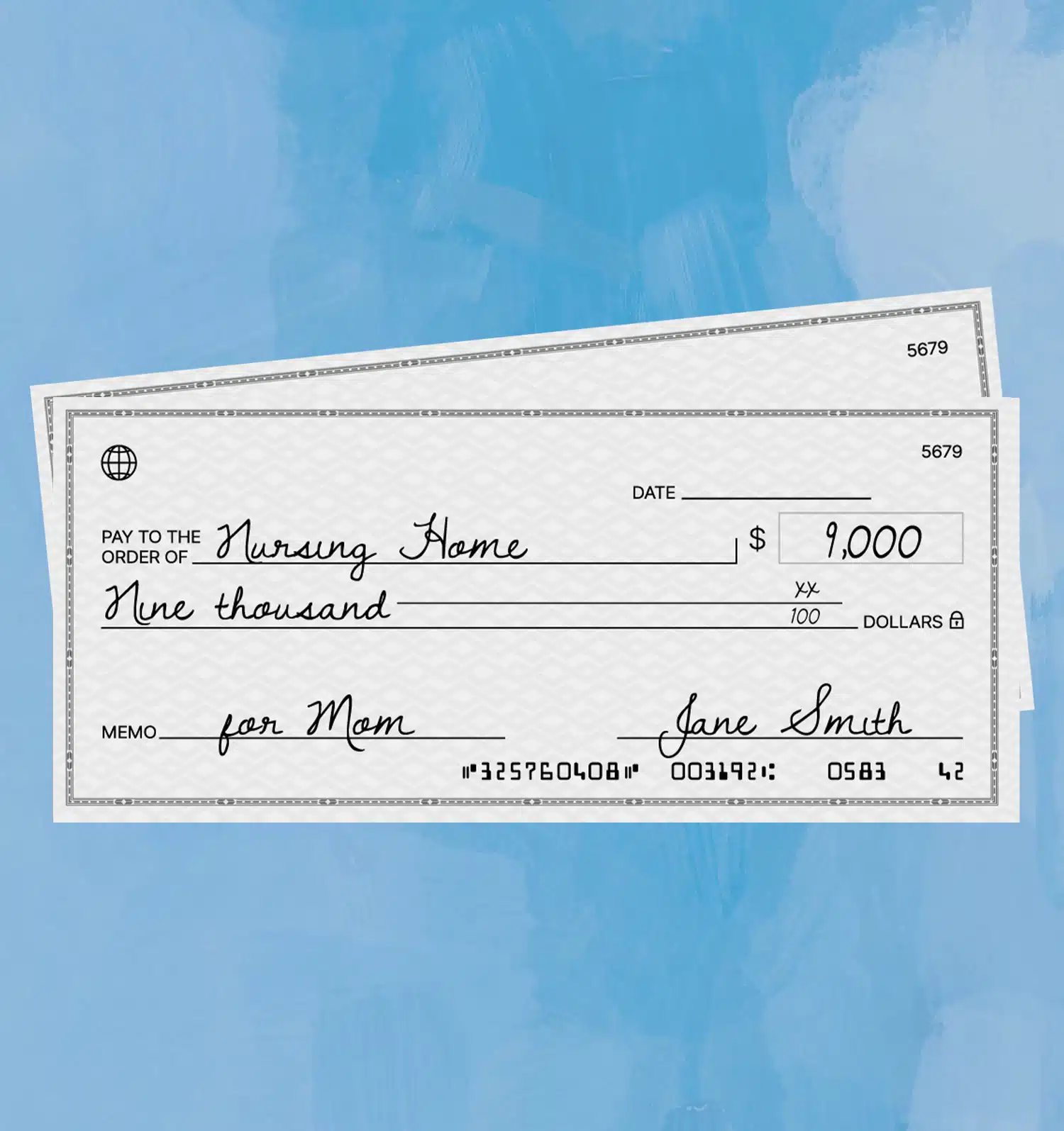

Nursing homes and other long-term care centers often suggest dipping into life savings to pay for services. We’ll help you structure your assets so you can protect your life savings.

Understand Your Legal Options

Our team of experienced attorneys is dedicated to helping seniors and their families tackle a wide range of issues, including Medicaid planning, asset protection, long-term care planning, and healthcare decision-making. We understand the unique challenges and concerns faced by seniors and their loved ones, and we are here to provide compassionate advice and advocacy. Feel free to explore our full range of services via the link below or schedule a consultation today to discuss customized support options and find the best solutions for your circumstances.

We Protect Your Home & Life Savings

Feel Confident About Your Decisions

Get personalized service, detailed attention for your unique circumstances, and custom solutions when you book a consultation with Elder Law Lawyers. Our team is transparent in sharing valuable insights on how we help safeguard client assets and secure the future of their loved ones. Reach out to us today to get started.

Serving Communities Throughout Northern Kentucky

Elder Law Lawyers is proud to serve clients in Lexington, Fort Mitchell, Covington, and beyond. With a focus on estate planning and special needs trusts, our team brings a wealth of experience to the table for long-term planning that creates financial security.